Income Tax E-Filing To Begin From March 1 2023 with new Interface and Website

MyTax, The Gateway to Tax Information. Everything now at your fingertips, https://mytax.hasil.gov.my/. LHDNM has improved the interface for e-BE (Year of Assessment 2020), which can be accessed using computers and smart devices. The change in interface is done to replace the m-Filing (m-BE) services.

Resident Individuals who do not carry on businesses can submit their e-BE (Year of Assessment 2022) via MyTax. The e-Filing system will be opened from 1st March 2023 and the submission deadline for e-BE (YA 2022) is on the 30th April 2023.Page 1 : Update and key in the blank for Particulars of Individual, Make sure all the detail is correct and not confusing.Page 2 : Update and key in the blank for Other Particulars, Make sure all the detail is correct and not confusing. Your income tax refund will be done through Electronic Fund Transfer (EFT) to your bank account. Kindly state the valid and correct and account number of your bank.Page 3 : key in the blank for Statutory Income and Total Income, Make sure all the detail is correct and not confusing.

*Important/Yang Penting

- Statutory income from sources of employment in Malaysia : The amount of money that a person receives for doing work in a company or organization. These include salaries, allowances, and bonuses.

- Pendapatan berkanun penggajian punca Malaysia : Jumlah wang yang diterima oleh seseorang kerana melakukan kerja di suatu syarikat atau organisasi. Ini termasuk gaji, elaun, dan bonus.

- Number of employment : The meaning number of employment is how many company we worked at this year.

- Bilangan penggajian : Maksud bilangan penggajian ialah berapa syarikat yang kita dapat gaji dalam tahun ini.

- Statutory income from sources of rents in Malaysia : Home rentals are any income or money you earn from renting residential property.

- Pendapatan berkanun sewa punca Malaysia : Pendapatan sewa rumah merupakan apa-apa hasil pendapatan atau wang yang anda perolehi daripada menyewa hartanah kediaman.

1. Automatic individual relief: RM9,000, Just by filling in the LHDN e-Filing form, you will be eligible for an automatic tax deduction of RM9,000. You’ll notice that this will be instantly greyed out on your form without you needing to do anything.

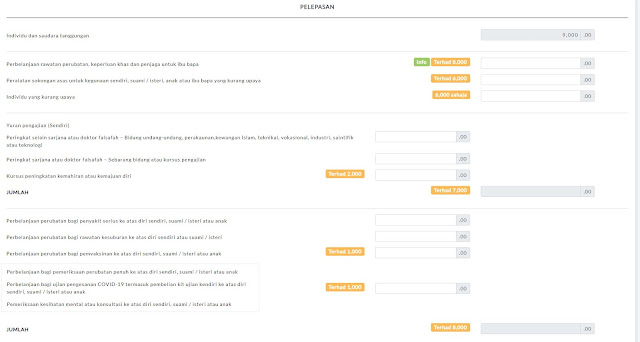

Page 4 : key in the blank for Relief year of assessment 2022, Individual Relief Types. Some amendments in tax reliefs have been made for YA 2022, and there are new additions introduced too. Claiming these incentives can help you lower your tax rate and pay less in overall taxes.

Page 5 : At Summary screen, e-Form will display your tax summary whether it is “Tax Paid In Excess” or “Tax Payable”. Users are able to verify entered information such as Total Income. Click on Continue button to submit your e-Form.Make sure you pay before the date listed below. Otherwise you will be charged additional charges and penalties.

- Start date of e-filing 2022 : March 1, 2023

- Deadline for efilling 2022 for individuals: 30 April 2023

- Malaysia dateline or Due date (private company): 30 June 2023

- Business LHDN Declare Closing Date: APRIL 30, 2023

To Be Continue.....

.JPG)

.JPG)

Comments

Post a Comment